NISA (Small Amount Investment Exemption Scheme) and Tax Reform

The tax reform of 2020 has significantly revised the NISA system, including the extension of the expiration date. The main points of the tax reform are explained below.

(1) Policy Objectives and Current Status of NISA

First, NISA has two main policy objectives. First, NISA has two main policy objectives: to provide stable asset formation and growth capital.

The general NISA was introduced in 2014 with the main objectives of both “supporting stable asset formation by households” and “providing funds for growth. It allows tax-free investment for five years with an annual investment limit of 1.2 million yen. ” The savings NISA ” was introduced in 2018 with the main purpose of “supporting stable asset building of household finances” by allowing long-term, accumulated, and diversified investments at low cost starting from a small amount. The maximum annual investment amount is 400,000 yen, which can be invested tax-free for 20 years.

Regarding the current situation, NISA is growing even though stock prices are said to be fluctuating wildly due to the impact of the new coronavirus and other factors, forcing even professional investors to make difficult decisions.

As of March 31, 2020, the number of general NISA accounts was 11.85 million (101.0% of the previous year) and the purchase amount was 19.1 trillion yen (107.2% of the previous year). The number of accounts for the “NISA” (installment savings plan) was 2.19 million (116.2% of the previous year’s level), and the purchase amount was ¥373.2 billion (125.5% of the previous year’s level), showing that the number of users and the purchase amount are increasing every year.

As of the end of March 2020, 70% of the general NISA users were seniors or those in their 50s or older, while nearly 70% of those using the savings NISA were young adults in their 20s to 40s. Of the 19.5 trillion yen in total NISA purchases, the total amount of purchases of listed stocks and investment trusts amounts to 19 trillion yen. These funds play an important role in supporting the Japanese economy by serving one of the policy objectives of NISA, which is to “provide funds for growth.

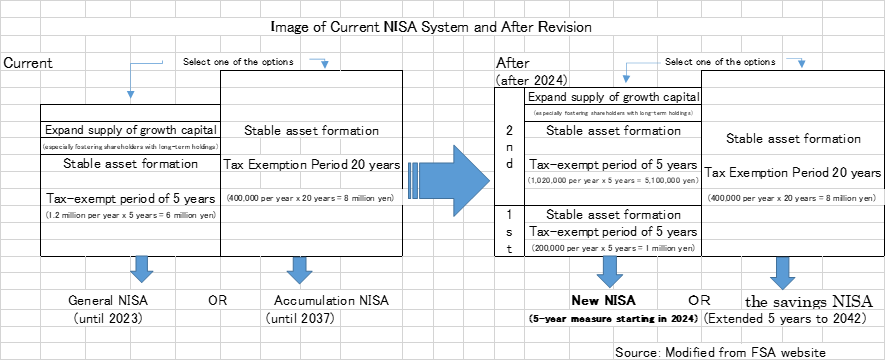

In addition, stock and currency markets fluctuate due to various factors. In particular, it is well known that the stock market has fluctuated greatly due to the recent new coronavirus and other factors. However, it is precisely in these unstable times that the NISA system is important to encourage “stable asset formation by households. Therefore, the NISA to be introduced in 2024 (called the New NISA) will be reviewed on two levels: a quota for small savings investments limited to low-risk products, and a quota for investments in conventional stock-type investment trusts and listed stocks.

(2) Details of the Amendments

The amendments include the following three points.

1 . The period during which an account can be opened for the savings NISA will be extended for five years.

2. The New NISA will be reconstituted as a two-tiered new system from 2024, with the first tier consisting of stable asset management of ¥200,000 per year for households and the second tier consisting of the same financial products as the General NISA for a total of ¥1,220,000 per year, for a maximum tax exemption of ¥6,100,000 since the tax exemption period is 5 years. The second floor is 1.02 million yen per year in the same financial products as the general NISA. In principle, the system will allow tax-exempt investments on the second floor (separate account) when tax-exempt savings investments are made on the first floor. In addition, the period during which accounts can be opened will be extended for five years. Since this mechanism is complicated and difficult to understand, it is summarized in Chart 1.

3. The Junior NISA will not be extended and will end at the end of 2023 .

Chart 1.